News

2026 Limits For Health Savings Accounts (HSA) And High Deductible Health Plans (HDHP)

The IRS released the 2026 Health Savings Account (HSA) contribution limits, the minimum required HDHP deductibles, and the HDHP out-of-pocket maximums. Each year, the IRS reviews these figures based on a cost-of-living adjustment. The figures below pertain to HSAs and HSA-qualified High Deductible Health Plans. 2026 Annual HSA Contribution Limits Single: $4,400 ($4,300 in 2025)…

Read MoreMary Cariola Center Radio Show Featuring Jennifer Noce – April 2025

Jennifer Noce joined the April 2025 edition of Mary Cariola Center Radio, sharing insights on the relationship between Cariola and the community. She discussed how Smola Consulting and community engagement supports Mary Cariola Center’s services and highlighted the power of partnerships and collaboration. Click Here to Listen

Read More2025 Tails of Hope Telethon

A Successful Tails of Hope Telethon In a heartwarming display of community spirit and generosity, Smola Consulting once again partnered with Lollypop Farm to support their annual Tails of Hope Telethon. This cherished event plays a pivotal role in raising funds that are essential for the humane society’s mission to enhance the lives of animals…

Read MoreMary Cariola Center Radio Show Featuring Dan Justis – January 2025

Embracing Growth While Staying Grounded “You’re perfect just the way you are, yet there is always room for improvement.” – Zen Quote This reminds us to embrace self-acceptance while staying open to growth. Approaching life with curiosity and openness allows us to see endless possibilities. 🔹 Habits & Mindset: Research shows it takes an average…

Read MoreShelly Avery Featured on the Mary Cariola Center Radio Show

In November 2024, Shelly Avery joined the Mary Cariola Radio Show to discuss the intricacies and benefits of Health Savings Accounts (HSAs). She provided insightful information on how HSAs can be a valuable tool for managing healthcare expenses. Discussed was important considerations when deciding on an HSA: Eligibility: Individuals must be enrolled in a high-deductible…

Read More2025 Contribution Limit For Flexible Spending Accounts (FSA)

The IRS announced that the maximum FSA contribution limit for 2025 will be $3,300, an increase of $100 from 2024. The limit is based on the employee and not the household. If an employee and spouse both have access to their own FSA through their respective employers, they are each eligible to contribute up to…

Read MoreLollypop Farm – 2024 Walk for the Animals at Barktober Fest

Smola Consulting was proud to sponsor of Lollypop Farm’s 2024 Barktober Fest and the Walk for the Animals, an event that promised to be a highlight for pet lovers and compassionate community members alike. People marked their calendars for Saturday, September 28th, and prepared for a day filled with fun, excitement, and an opportunity to…

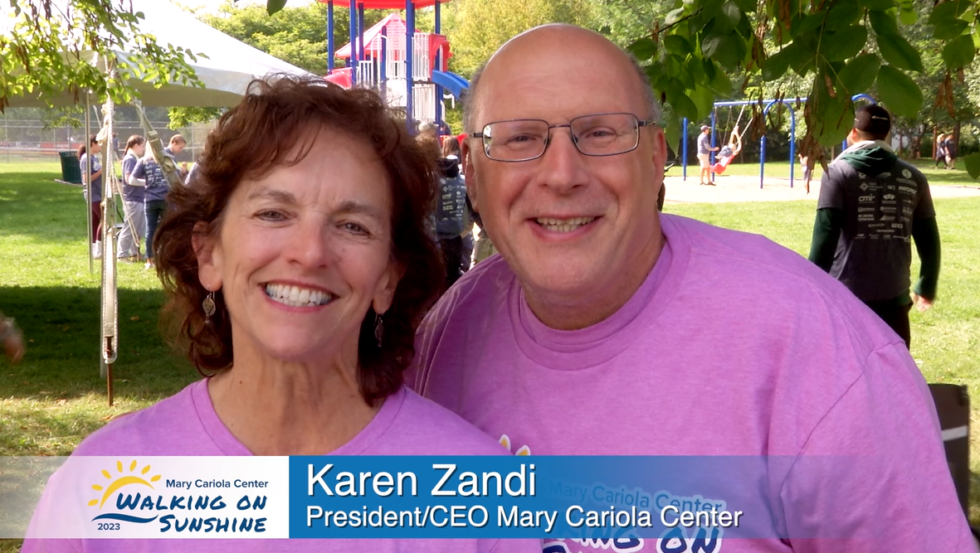

Read MoreSmola Consulting Supports Mary Cariola Center’s Walking on Sunshine 2024

Mary Cariola Center and Smola Consulting – Thank you! Mary Cariola Center is celebrating another successful year of their annual Walking on Sunshine event. This year, the event raised an over $175,000, which will significantly benefit the center’s mission of providing comprehensive services and care for individuals with complex disabilities. The Walking on Sunshine event…

Read More2025 New York Paid Family Leave (PFL)

In September 2024, the 2025 New York Paid Family Leave (PFL) employee contribution rates and updated annual cap were announced. As of January 1, 2025 the following will take effect: The state has set forth the following PFL rules which will also take effect from 1/1/2025: Premiums should be withheld from employees’ gross wages, until…

Read MoreCommunity, Compassion, and Commitment

Every year, as the days grow warmer and the sun shines brighter, Smola Consulting eagerly anticipates the Mary Cariola Center’s Walking on Sunshine fundraising event. This annual event is not just a walk; it is a testament to the power of community, compassion, and the commitment to support individuals with complex disabilities. Volunteering at Walking…

Read MoreJune 2024: Sunshine the Safe Way

June 2024: Sunshine the Safe Way

Read MoreDan Justis Featured on the Mary Cariola Center Radio Show

On May 16, 2024, Dan shared his insights on simplifying wellness routines during an engaging discussion on Mary Cariola’s radio show. His approach to wellness emphasizes ease, accessibility, and sustainability, allowing individuals to tailor their routines to fit seamlessly into their daily lives. Dan’s philosophy on wellness revolves around a few core principles that help…

Read More2025 Limits For Health Savings Accounts (HSA) And High Deductible Health Plans (HDHP)

The IRS released the 2025 Health Savings Account (HSA) contribution limits, the minimum required HDHP deductibles, and the HDHP out-of-pocket maximums. Each year, the IRS reviews these figures based on a cost-of-living adjustment. The figures below pertain to HSAs and HSA-qualified High Deductible Health Plans. 2025 Annual HSA Contribution Limits Single: $4,300 ($4,150 in 2024)…

Read MoreApril 2024: Living Springs Essence

April 2024 Living Springs Essence

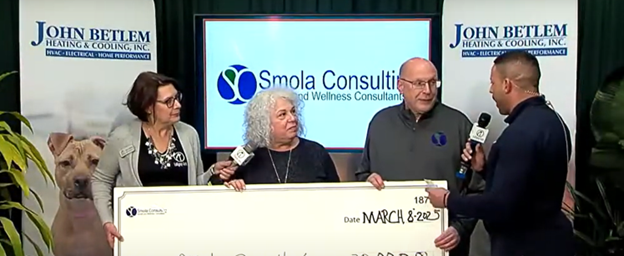

Read More2024 Goodwill Gala

Goodwill of the Finger Lakes and Smola Consulting hosted the 2024 Goodwill Gala on March 9 at the Hyatt Regency. The event, themed “Elevating Community. Empowering Connections,” raised more than $225,435 for Goodwill’s many community programs and services, focusing on 211/LIFE LINE.

Read More2024 Tails of Hope Telethon

Smola Consulting was honored to once again support Lollypop Farm, the Humane Society of Greater Rochester, in raising nearly $500,000 at its 28th Annual Tails of Hope Telethon. The telethon supports the organization’s mission to better the lives of animals through justice, prevention and life-saving care. It featured stories of pets saved, live interviews with…

Read MoreFebruary 2024 – Mastering the Clock (The Art of Effective Time Management)

February 2024 – Mastering the Clock (The Art of Effective Time Management)

Read MoreMarch 2024 – Sustainable Living (Fostering Personal & Global Well-being

Sustainable & Conscientious Living: Fostering Personal & Global Well-being

Read MoreJanuary 2024 – Shaping Intelligent Money Habits

Shaping Intelligent Money Habits

Read MoreDecember 2023 – The New Science of Spirituality

The New Science of Spirituality

Read MoreNovember 2023 – Boosting Immunity Naturally

Boosting Immunity Naturally

Read More2024 Contribution Limit For Flexible Spending Accounts (FSA)

The IRS announced that the maximum FSA contribution limit for 2024 will be $3,200, an increase of $150 from 2023. The limit is based on the employee and not the household. If an employee and spouse both have access to their own FSA through their respective employers, they are each eligible to contribute up to…

Read MoreShelly Avery Featured in Mary Cariola Center’s CEO Blog on Open Enrollment

Open enrollment is the only time of the year that you can make changes to your health plan. Take the time to understand your premiums, cost, and benefits to make the best decision for you and your family to stay healthy and financially secure. Premiums – How much do you pay for your insurance? Open…

Read MoreOctober 2023 – Emotional Intelligence Mastery

Positive Pulse (Oct 2023) Emotional Intelligence Mastery

Read More2023 Walking on Sunshine

Once again, Smola Consulting joined Mary Cariola Center and over 1,000 walkers to raise over $150,000 at their largest annual community fundraiser. This family friendly event supports children with complex, multiple disabilities from ten counties and 50 school districts. Click Here to See Full Video

Read MoreSeptember, 2023 – Health Amid Hardship

Positive Pulse – Health Amid Hardship

Read MoreJuly 2023 – Entertainment for Well-being

Positive Pulse – Entertainment for Well-being

Read MoreJune, 2023 – National Camping Month

Positive Pulse – National Camping Month

Read More2024 New York Paid Family Leave (PFL)

As of January 1, 2024 the following will take effect regarding the 2024 New York Paid Family Leave (PFL): The state has set forth the following PFL rules which will also take effect from 1/1/2024: Premiums should be withheld from employees’ gross wages, until the annual cap is reached, which may occur prior to the…

Read MoreMay 2023 – Employee Health & Fitness Month

National Employee Health & Fitness Month

Read MoreApril 2023 – National Lawn & Garden Month

National Lawn & Garden Month

Read More2024 Limits For Health Savings Accounts (HSA) And High Deductible Health Plans (HDHP)

The IRS released the 2024 Health Savings Account (HSA) contribution limits, the minimum required HDHP deductibles, and the HDHP out-of-pocket maximums. Each year, the IRS reviews these figures based on a cost-of-living adjustment. The figures below pertain to HSAs and HSA-qualified High Deductible Health Plans. 2024 Annual HSA Contribution Limits Single: $4,150 ($3,850 in 2023)…

Read MoreMarch 2023 – National Nutrition Month

Between busy schedules and soaring grocery prices, eating nutritiously can be a daunting endeavor. However, there are still ways that we can consume healthy (and delicious) meals while maintaining a reasonable grocery budget. If there is anything worth the time and energy to plan, it is what we are putting into our bodies to fuel…

Read MoreFebruary 2023 – Self-Check Month

National Self-Check Month is a great reminder that we are empowered to take charge of our health. Self-selected preventative check-ups are one of the best ways to mitigate chronic disease and other often preventable lifestyle-related conditions. We all have our reasons for avoiding a checkup. We’re too busy, we don’t want to know the truth,…

Read MoreGoodwill of the Finger Lakes, Dancing in Denim Gala

On Saturday, March 11th, Goodwill of the Finger Lakes and Smola Consulting put on an unforgettable evening of fun and philanthropy. The annual gala, “Dancing in Denim,” was held at the luxurious Hyatt Regency in downtown Rochester. Guests were treated to a night of excitement, with a silent and live auction, delicious dinner and open…

Read MoreTails of Hope Telethon

Smola Consulting’s unwavering commitment to supporting The Tails of Hope Telethon to benefit Lollypop Farm has once again yielded great success. Thanks to the generosity of all donors, the event raised an astounding $444,707. We are immensely grateful to everyone who contributed to this noble cause and helped make a difference in the lives of…

Read MoreEnd COVID-19 National and Public Health Emergencies on May 11, 2023

Per the 1/31/2023 Statement of Administration Policy by President Biden: The COVID-19 national emergency and public health emergency (PHE) were declared by the Trump Administration in 2020. They are currently set to expire on March 1 and April 11, 2023, respectively. At present, the Biden Administration’s plan is to extend the emergency declarations to May…

Read MoreJanuary 2023 – National Hobby Month

January 2023 – National Hobby Month A hobby is any activity that you enjoy doing for the sake of the activity itself. Hobbies can be athletic, creative, or academic but what matters most is that it is something you find meaningful and enjoyable. Hobbies can range from spending quiet time alone, visiting with others, communing…

Read MoreDecember 2022 – Joy to the World

December 2022 – Joy to the World Cultivating joy is intentionally bringing joy into one’s own life. For some people, December is a time filled with joy and happiness. The holiday season brings many festivities and time spent with family. However, for other people, the holiday season can emphasize feelings of loss or loneliness. Whether…

Read MoreNovember 2022 – Financial Wellness

November 2022 – Financial Wellness https://www.smore.com/3ab5kj

Read More2022 Barktoberfest: Walk for the Animals

2022 Barktoberfest: Walk for the Animals Smola Consulting was again a proud sponsor of The Walk for the Animals at Barktoberfest on September 24th. This is the second largest fundraiser to support vital services and programs for the homeless and abused pets in our community. There was fun and activities for pets and the whole…

Read More2023 Contribution Limit For Flexible Spending Accounts (FSA)

The IRS announced that the maximum FSA contribution limit for 2023 will be $3,050, an increase of $200 from 2022. The limit is based on the employee and not the household. If an employee and spouse both have access to their own FSA through their respective employers, they are each eligible to contribute up to…

Read MoreAugust 2022 – Cultivating Peace

August 2022 – Cultivating Peace

Read MoreSeptember 2022 – Suicide Awareness Month

August 2022 – Suicide Awareness Month

Read MoreJuly 2022 – Wellness on Vacation

July 2022 – Wellness on Vacation

Read More2023 New York Paid Family Leave (PFL)

On 9/1/2022, the 2023 New York Paid Family Leave (PFL) employee contribution rates and updated annual cap were announced. As of January 1, 2023 the following will take effect:• Premium Deduction Rate: 0.455% (down from 0.511% in 2022)• Statewide Average Weekly Wage: $1,688.19 (up from $1,594.57 in 2022)• Annual Contribution Cap: $399.43 (down from $423.71…

Read More2022 Wellness Professional Development Day

On June 1st, 2022 Smola Consulting in partnership with Finger Lakes Area School Health Plan Consortium hosted a one-of-a-kind Wellness Professional Development Day. This unique event encouraged wellness champions to learn best practices, network, participate in wellness activities and begin considering and planning wellness activities for their organization. Smola welcomed local leaders in well-being as…

Read MoreMay 2022 – Correct Your Posture

Correct Your Posture

Read MoreApril 2022 – National Humor Month

National Humor Month

Read More2023 Limits For Health Savings Accounts (HSA) And High Deductible Health Plans (HDHP)

The IRS released the 2023 Health Savings Account (HSA) contribution limits, the minimum required HDHP deductibles, and the HDHP out-of-pocket maximums. Each year, the IRS reviews these figures based on a cost-of-living adjustment. The figures below pertain to HSAs and HSA-qualified High Deductible Health Plans. 2023 Annual HSA Contribution Limits Single: $3,850 ($200 increase from…

Read MoreLollypop Farm – Annual Tails of Hope Telethon

The Smola Consulting Team was proud to again sponsor and support The 25th Tails of Hope Telethon which ensures veterinary services and life saving care for homeless and abused pets. Over $535,0000 was raised which is the most successful telethon yet! We are extremely proud to support such an invaluable community resource as Lollypop Farm.

Read MoreMarch 2022 – National Nutrition Month

National Nutrition Month

Read MoreFebruary 2022 – American Heart Month

American Heart Month

Read MoreA Brand New Wellness Program! The Weekly LEAP

January 2022 – National Blood Donor Month

January 2022 – National Blood Donor Month

Read More2022 Wellness Speaker Series Announcement

We are excited to announce our 2022 Wellness Speaker Series, themed ‘A Holistic Approach to Balanced Living’, and we’re starting off with a bang. Kicking off the series are Travis Eliot and Lauren Eckstrom, world-renowned yoga and mindfulness teachers and co-founders of the premium streaming platform, Inner Dimension Media TV. Balanced living in a do-it-all…

Read MoreDecember 2021 – Holiday DeStress Part 2

December 2021 Holiday DeStress Part 2

Read MoreNovember 2021 – Holiday DeStress Part 1

November 2021 Holiday DeStress Part 1

Read More2022 Contribution Limit For Flexible Spending Accounts (FSA)

The IRS announced that the maximum FSA contribution limit for 2022 will be $2,850, an increase of $100 from 2021. The limit is based on the employee and not the household. If an employee and spouse both have access to their own FSA through their respective employers, they are each eligible to contribute up to…

Read MoreLollypop Farm | Human Society of Greater Rochester’s Barktober Fest

Smola Consulting was proud to again sponsor the Lollypop Farm Barktoberfest on September 12th. Both pets and humans were able to participate in so many new activities this year. This pet friendly event benefits our community’s homeless and abused pets.

Read MoreOctober – Global Diversity Awareness

October 2021

Read MoreMary Cariola Center’s “Walking on Sunshine”

Smola Consulting was once again a titanium sponsor of Mary Cariola Center’s “Walking on Sunshine” fundraising event on Sunday, September 21st, 2021. We welcomed more than 1,000 supportive walkers for this family-friendly event, supporting children with multiple and complex disabilities. The Walk was full of fun activities that were enjoyed by all. The event raised…

Read MoreSeptember 2021 Self-Care Awareness

September 2021

Read More2022 New York Paid Family Leave (PFL)

The 2022 New York Paid Family Leave (PFL) employee contribution rates and updated annual cap were announced. As of January 1, 2022 the following will take effect: Premium Deduction Rate: 0.511% (same as 2021) Statewide Average Weekly Wage: $1,594.57 (up from $1,450.17 in 2021) Annual Contribution Cap: $423.71 (up from $385.34 in 2021) The state…

Read MoreAugust 2021

August 2021

Read MoreJuly 2021

July 2021

Read MoreJune 2021

June 2021

Read MoreSpecial Edition – Mental Health Awareness

Special Edition – Mental Health Awareness

Read MoreMay 2021

May 2021

Read MoreApril 2021

April 2021

Read MoreMarch 2021

March 2021

Read MoreFebruary 2021

February 2021

Read MoreJanuary 2021

January 2021

Read MoreDecember 2020

December 2020

Read MoreNovember 2020

November 2020

Read MoreOctober 2020

October 2020

Read MoreSeptember 2020

September 2020

Read MoreAugust 2020

August 2020

Read MoreJuly 2020

July 2020

Read MoreJune 2020

June 2020

Read MoreMay 2020

May 2020

Read MoreApril 2020

April 2020

Read MoreMarch 2020

March 2020

Read More2022 Limits For Health Savings Accounts (HSA) And High Deductible Health Plans (HDHP)

The IRS released the 2022 Health Savings Account (HSA) contribution limits, the minimum required HDHP deductibles, and the HDHP out-of-pocket maximums. Each year, the IRS reviews these figures based on a cost-of-living adjustment. The figures below pertain to HSAs and HSA-qualified High Deductible Health Plans. 2022 Annual HSA Contribution Limits Single: $3,650 ($50 increase from…

Read MoreRed Jacket Central School District Finds Value in the Lift Project While Contributing to the Local Community

The Lift Project is an educational program designed to support individuals on how to lift their mood and their life. The Lift Project involves 10 fascinating lessons, taken over 10 weeks. Participants learn and experience scientifically proven ways to feel better and live more! Employees and Leadership completed their coursework and as part of the…

Read MoreCOBRA Subsidy

On March 11, 2021, President Biden signed into law the American Rescue Plan Act (ARPA). As part of the ARPA, several provisions were included that relate to the continuation of insurance benefits, known as COBRA (Consolidated Omnibus Budget Reconciliation Act). Specifically: There is a 100% Medical, Dental and Vision (not FSA) premium subsidy for those…

Read MoreCoronavirus Disease 2019 (COVID-19)

Dear Valued Partner, We understand that COVID19 has had significant and far-reaching impacts on all aspects of living, including broad shifts in workplace operations, culture, and benefits. Smola Consulting is continuing to monitor pandemic trends and explore resources to share best practices, raise public awareness, and support and advocate worksite vaccination efforts. As the COVID19…

Read MoreAnnouncing the 4th Annual 10-Day Whole Food Plant-Based Challenge – January 11-20

We are very excited to announce the 2021 Good Life Challenge, our 4th annual 10-Day Whole Food Plant-Based Challenge. This year’s Challenge begins on Monday January 11 and concludes on Wednesday January 20.

Read MoreThe Lift Project – Success and Impact on the Local Community

On behalf of the Penn Yan Central School District and the Finger Lakes Area School Health Plan (FLASHP), Smola Consulting registered 17 people for The Lift Project in October of 2020. This progressive group of employees completed their coursework and a component of the program is that the Lift Project donates 10% of the course…

Read More2020 and 2021 FSA Changes

On December 27, 2020, President Trump signed the year-end spending bill. In that bill included language that makes Flexible Spending Accounts (FSAs) temporarily more advantageous. The temporary rule: Allows plans to permit Health FSAs and Dependent Care FSAs to carryover unused benefits, up to the full annual amount, from 2020 to 2021, and from 2021…

Read MoreSmola Consulting Was a Titanium Sponsor For the Mary Cariola Fundraiser

Walking on Sunshine goes virtual and becomes Walking on Sunshine Weekend! Smola Consulting was again proud to be a titanium sponsor of this great event. The Sunshine Crew provided fun and innovative activities for all Walking on Sunshine participants including a virtual kick off event, pep rally, swag bag, cool t-shirts, the Mary Cariola Company…

Read MoreSmola Consulting Sponsors ABVI Summon the Spirits Gala

The Association for the Blind and Visually Impaired Hosted their Summon the Spirits Gala 2020 on October 15th. Smola Consulting was proud to be the presenting sponsor of this fantastic virtual fundraising event. The event was attended by the Rochester community from the comfort of their homes own Doug Emblidge of 13 WHAM TV led…

Read More2021 Contribution Limit For Flexible Spending Accounts (FSA)

The IRS announced that the maximum FSA contribution limit for 2021 will not change from 2020, and remain at $2,750. The limit is based on the employee and not the household. If an employee and spouse both have access to their own FSA through their respective employers, they are each eligible to contribute up to…

Read More2021 New York Paid Sick Leave (NYPSL)

Below is a summary of the details and guidance regarding New York’s new paid sick leave law. As of now, there is little formal guidance outside of the statutory language itself. However, as the effective date approaches, we expect regulatory or other guidance from the New York Department of Labor to be issued in the…

Read More2021 New York Paid Family Leave (PFL)

On September 1, 2020, the 2021 New York Paid Family Leave (PFL) employee contribution rates and updated annual cap were announced. As of January 1, 2021 the following will take effect: Premium Deduction Rate: 0.511% (up from 0.270% in 2020) Statewide Average Weekly Wage: $1,450.17 (up from $1,401.17 in 2020) Annual Contribution Cap: $385.34 (up…

Read MoreHSA Cafeteria Plan

For clients who offer a qualified High Deductible Health Plan with a Health Savings Account (HSA) allowing for pre-tax HSA contributions, you should have in place a separate written Cafeteria Plan for that HSA. Cafeteria Plans are employee reimbursement plans that are governed by Section 125 of the IRS tax code. When employers establish Cafeteria…

Read More2021 Limits For Health Savings Accounts (HSA) And High Deductible Health Plans (HDHP)

The IRS released the 2021 Health Savings Account (HSA) contribution limits, the minimum required HDHP deductibles, and the HDHP out-of-pocket maximums. Each year, the IRS reviews these figures based on a cost-of-living adjustment. The figures below pertain to HSAs and HSA-qualified High Deductible Health Plans. 2021 Annual HSA Contribution Limits Single: $3,600 ($50 increase from…

Read MoreFSA Changes

In response to COVID-19, the IRS released new relief affecting Flexible Spending Accounts (FSAs) and Dependent Care Assistance Programs (DCAPs). Extended Claim Period The claims period has been extended to apply unused amounts remaining in a Health FSA, or DCAP, for expenses incurred for those same qualified benefits, through December 31, 2020. Mid-Year Elections Participants…

Read MoreFebruary 2020

February 2020

Read More1095-B Changes

Form 1095-B is used to report certain information to the IRS and to taxpayers about individuals who are covered by minimum essential coverage. Taxpayers are not required to include Form 1095-B with their tax return. However, health insurers are required to make the form available to members for their records. The IRS made changes…

Read MoreJanuary 2020

January 2020

Read MoreCadillac Tax Repealed

On December 20, 2019, President Trump signed the Consolidated Appropriations Act, 2020, repealing the Affordable Care Act’s (ACA) Cadillac Tax. The U.S. Senate voted 71-23 on December 19, 2019, to approve the spending bill that included a repeal of the ACA’s excise tax on high-cost, employer-sponsored healthcare plans, also known as the “Cadillac Tax.”…

Read MoreDecember 2019

December 2019

Read More2020 Contribution Limit For Flexible Spending Accounts (FSA)

The IRS announced that the maximum FSA contribution limit for 2020 will increase by $50, from $2,700 to $2,750. The FSA limit increase is effective for FSA plan years beginning on or after January 1, 2020. The limit is based on the employee and not the household. If an employee and spouse both…

Read MoreNovember 2019

November 2019

Read MoreOctober 2019

October 2019

Read More2020 New York Paid Family Leave (PFL)

Recently, the 2020 New York Paid Family Leave (PFL) employee contribution rates and updated annual cap were announced. As of January 1, 2020, the following will take effect: Premium Deduction Rate: 270% (up from 0.153% in 2019) Statewide Average Weekly Wage: $1,401.17 (up from $1,357.11 in 2019) Annual Contribution Cap: $196.72 (up from $107.97 in…

Read MoreSeptember 2019

September 2019

Read MoreAugust 2019

[pdf-embedder url=”https://smolaconsulting.com/wp-content/uploads/August-2019.pdf” title=”August 2019″]

Read More2020 Changes to Health Reimbursement Accounts (HRAs)

On June 20, 2019, new Health Reimbursement Account (HRA) rules were released by the Departments of Labor, Health and Human Services, and the Treasury, which can be found here. The changes go into effect for plan years beginning on or after January 1, 2020, and introduce two new types of HRAs: Individual Coverage HRA (ICHRA)…

Read MoreJuly 2019

[pdf-embedder url=”https://smolaconsulting.com/wp-content/uploads/July-2019.pdf” title=”July 2019″]

Read MoreJune 2019

[pdf-embedder url=”https://smolaconsulting.com/wp-content/uploads/June-2019.pdf” title=”June 2019″]

Read More2020 Limits For Health Savings Accounts (HSA) And High Deductible Health Plans (HDHP)

The IRS released the 2020 Health Savings Account (HSA) contribution limits, the minimum required HDHP deductibles, and the HDHP out-of-pocket maximums. Each year, the IRS reviews these figures based on a cost-of-living adjustment. The figures below pertain to HSAs and HSA-qualified High Deductible Health Plans. 2020 Annual HSA Contribution Limits Single: $3,550 ($50…

Read MoreMay 2019

[pdf-embedder url=”https://smolaconsulting.com/wp-content/uploads/May-2019.pdf” title=”May 2019″]

Read MoreApril 2019

[pdf-embedder url=”https://smolaconsulting.com/wp-content/uploads/April-2019.pdf” title=”April 2019″]

Read MoreABVI Celebrated 50 Years of Providing Low Vision Services During 2019 Visionary Gala: Hearts of Gold presented by Smola Consulting

The Association for the Blind and Visually Impaired (ABVI), a mission program of Goodwill of the Finger Lakes, celebrated 50 years of providing Low Vision Services to the Finger Lakes region at its 2019 Visionary Gala: Hearts of Gold presented by Smola Consulting, took place on Saturday, March 9, 2019 from 6:00-9:00 pm at the…

Read MoreMarch 2019

[pdf-embedder url=”https://smolaconsulting.com/wp-content/uploads/March-2019.pdf” title=”March 2019″]

Read MoreFebruary 2019

[pdf-embedder url=”https://smolaconsulting.com/wp-content/uploads/February-2019.pdf” title=”February 2019″]

Read MoreJanuary 2019

[pdf-embedder url=”https://smolaconsulting.com/wp-content/uploads/January-2019.pdf” title=”January 2019″]

Read MoreDecember 2018

[pdf-embedder url=”https://smolaconsulting.com/wp-content/uploads/Positive-Pulse-December-2018.pdf” title=”Positive Pulse December- 2018″]

Read More2019 Contribution Limit For Flexible Spending Accounts (FSA)

The IRS announced that the maximum FSA contribution limit for 2019 will increase by $50, from $2,650 to $2,700. The FSA limit increase is effective for FSA plan years beginning on or after January 1, 2019. The limit is based on the employee and not the household. If an employee and spouse both…

Read MoreNovember 2018

November- 2018

Read More2019 New York Paid Family Leave (PFL)

In October 2018, the 2019 New York Paid Family Leave (PFL) employee contribution rates and updated annual cap were announced. As of January 1, 2019, the following will take effect. Premium Deduction Rate: 153% (up from 0.126% in 2018) Statewide Average Weekly Wage: $1,357.11 (up from $1,305.92 in 2018) Annual Contribution Cap: $107.97 (up from…

Read MoreOctober 2018

[pdf-embedder url=”https://smolaconsulting.com/wp-content/uploads/Positive-Pulse-October-2018.pdf” title=”Positive Pulse October- 2018″]

Read MoreSeptember 2018

[pdf-embedder url=”https://smolaconsulting.com/wp-content/uploads/Positive-Pulse-September-2018.pdf” title=”Positive Pulse September- 2018″]

Read MoreAugust 2018

[pdf-embedder url=”https://smolaconsulting.com/wp-content/uploads/Positive-Pulse-August-2018.pdf” title=”Positive Pulse August 2018″]

Read MoreJuly 2018

[pdf-embedder url=”https://smolaconsulting.com/wp-content/uploads/Positive-Pulse-July-2018.pdf” title=”Positive Pulse July – 2018″]

Read MoreThe Power of Wellness in the Workplace

Clients enjoyed a morning of wellness on May 24th with Keynote Speaker Lisa Norsen, Chief Wellness Officer, UR Medicine Employee Wellness, followed by a Mindful Movement Activity with Marla Pellitier, Inward Office. Smola Consulting Clients, Seneca Falls CSD and Goodwill of the Finger Lakes also shared some “Proof Positive” wellness success from their organizations. Rick…

Read MoreJune 2018

[pdf-embedder url=”https://smolaconsulting.com/wp-content/uploads/Positive-Pulse-June-2018.pdf” title=”Positive Pulse June – 2018″]

Read More2019 Limits For High Deductible Health Plans (HDHP) And Health Savings Accounts (HSA)

The IRS released the 2019 Health Savings Account (HSA) contribution limits, the minimum required HDHP deductibles, and the out-of-pocket maximums. Each year, the IRS reviews these figures based on a cost-of-living adjustment. The figures below pertain to HSAs and HSA-qualified High Deductible Health Plans. 2019 Annual HSA Contribution Limits Single: $3,500 ($50 increase…

Read MoreMay 2018

[pdf-embedder url=”https://smolaconsulting.com/wp-content/uploads/Positive-Pulse-May-2018.pdf” title=”Positive Pulse May – 2018″]

Read More2018 HSA Limits – Reverted Back

2018 Limits For High Deductible Health Plans (HDHP) And Health Savings Accounts (HSA) In May 2017, the IRS originally released the 2018 Health Savings Account (HSA) contribution limits, the minimum required HDHP deductibles, and the out-of-pocket maximums (https://www.irs.gov/pub/irs-drop/rp-17-37.pdf). However, the December 2017 passing of the Tax Reform Bill led to a review of the…

Read MoreApril 2018

[pdf-embedder url=”https://smolaconsulting.com/wp-content/uploads/Positive-Pulse-April-2018.pdf” title=”Positive Pulse April – 2018″]

Read MoreSmola Consulting Teams Up Again in 2018 to Support the Lollypop Farm Tails of Hope Telethon – March 2018.

The Tails of Hope Telethon is the annual fundraiser that helps to fund the many great programs for pets in need. Smola Consulting supports this important annual fundraiser so that Lollypop Farm can provide food, shelter, veterinary services, and other forms of compassionate care for hundreds of pets every day. We are committed to providing…

Read MoreKnighthawks and Smola Consulting Team Up to Support a Great Community Organization – Association for the Blind and Visually Impaired (ABVI)- December 2017

Smola Consulting is proud to partner with the Rochester Knighthawks to benefit one of Rochester’s great community assets, The Association for the Blind and Visually Impaired , an affiliate of Goodwill of the Finger Lakes.. Smola Consulting is donating $3 for each save the Knighthawks make during the 2018-2018 season. Smola Consulting is delighted to…

Read MoreRochester’s Small Business National Philanthropy Award – November 2017

https://vimeo.com/242581719Steve Smola honored as 2017 Outstanding Small Business Philanthropist – Doing good things for the right reasons! On National Philanthropy Day, The Association of Fundraising Professionals – Genesee Valley Chapter held their annual awards luncheon on Friday November 3, 2017. Mary Cariola Children’s Center, a Smola Consulting Client nominated Steve Smola for this wonderful award.…

Read More2018 HSA Limits – Updated

In May 2017, the IRS originally released the 2018 Health Savings Account (HSA) contribution limits, the minimum required HDHP deductibles, and the out-of-pocket maximums (https://www.irs.gov/pub/irs-drop/rp-17-37.pdf). However, the December 2017 passing of the Tax Reform Bill led to a review of the limits. Each year, the IRS reviews these figures based on a cost-of-living adjustment. …

Read MoreMarch 2018

[pdf-embedder url=”https://smolaconsulting.com/wp-content/uploads/Positive-Pulse-March-2018-2.pdf” title=”Positive Pulse March – 2018″]

Read MoreFebruary 2018

[pdf-embedder url=”https://smolaconsulting.com/wp-content/uploads/Positive-Pulse-February-2018.pdf” title=”Positive Pulse February – 2018″]

Read MoreJanuary 2018

[pdf-embedder url=”https://smolaconsulting.com/wp-content/uploads/Positive-Pulse-January-2018.pdf” title=”Positive Pulse January – 2018″]

Read MoreSuspension of Obamacare Taxes, Including the Cadillac Tax

On January 23, 2018, Congress passed, and President Trump signed into law, a stopgap spending deal that ended the shutdown of the federal government. Included in this deal are the suspensions of three taxes: The Cadillac Tax was delayed for two additional years, from 2020 until 2022. This tax would have imposed a 40% surcharge…

Read MoreNew Medicare Health Insurance Cards For Those Over Age 65 and Medicare Eligible

In an effort to prevent fraud, fight identity theft, and keep taxpayer dollars safe, Centers for Medicare & Medicaid Services (CMS) is removing Social Security Numbers (SSN) from Medicare cards in a year-long phased approach, beginning April 2018. The Medicare Access and CHIP Reauthorization Act (MACRA) of 2015 requires the removal of Social Security Numbers…

Read More2018 Contribution Limit For Flexible Spending Accounts (FSA)

The IRS has announced that the maximum FSA contribution limit for 2018 will increase by $50 – from $2,600 to $2,650. The FSA limit increase is effective for FSA plan years beginning on or after January 1, 2018. The limit is based on the employee and not the household. If an employee and spouse both…

Read MoreDecember 2017

[pdf-embedder url=”https://smolaconsulting.com/wp-content/uploads/Positive-Pulse-December-2017.pdf” title=”Positive Pulse – December 2017″]

Read MoreNovember 2017

[pdf-embedder url=”https://smolaconsulting.com/wp-content/uploads/Positive-Pulse-November-2017.pdf” title=”Positive Pulse November 2017″]

Read MoreOctober 2017

[pdf-embedder url=”https://smolaconsulting.com/wp-content/uploads/Positive-Pulse-October-2017.pdf” title=”Positive Pulse October 2017″]

Read MoreSeptember 2017

[pdf-embedder url=”https://smolaconsulting.com/wp-content/uploads/Positive-Pulse-September-2017.pdf” title=”Positive Pulse – September 2017″]

Read MoreAugust 2017

[pdf-embedder url=”https://smolaconsulting.com/wp-content/uploads/Positive-Pulse-August-2017.pdf” title=”Positive Pulse August 2017″]

Read MoreJuly 2017

[pdf-embedder url=”https://smolaconsulting.com/wp-content/uploads/Positive-Pulse-July-2017.pdf” title=”Positive Pulse July 2017″]

Read MoreJune 2017

[pdf-embedder url=”https://smolaconsulting.com/wp-content/uploads/Positive-Pulse-June-2017.pdf” title=”Positive Pulse June 2017″]

Read MoreMay 2017

[pdf-embedder url=”https://smolaconsulting.com/wp-content/uploads/Positive-Pulse-May-2017.pdf” title=”Positive Pulse May 2017″]

Read MoreNYS Department of Taxation and Finance Notice on New York Paid Family Leave (PFL)

This is a follow-up from the Smola Consulting Benefits Bulletin posted on 7/21/2017 regarding New York Paid Family Leave (PFL) benefits starting January 1, 2018 for new parents, family members caring for sick relatives, and employees with family members deployed abroad on active military duty. The New York State Department of Taxation and Finance just…

Read MoreFinal Regulations Released on New York Paid Family Leave (PFL)

On Wednesday July 19, 2017, the New York State Workers Compensation Board posted Final Regulations regarding New York Paid Family Leave (PFL), which takes effect on January 1, 2018. Final regulations can be found here: http://www.wcb.ny.gov/PFL/pfl-regs.jsp Governor Andrew Cuomo announced that the state has adopted regulations implementing New York’s Paid Family Leave program. These regulations…

Read More2018 Limits For High Deductible Health Plans (HDHP) And Health Savings Accounts (HSA)

The IRS released the 2018 Health Savings Account (HSA) contribution limits, the minimum required HDHP deductibles, and the out-of-pocket maximums. Each year, the IRS reviews these figures based on a cost-of-living adjustment. The figures below pertain to HSA’s and HSA-qualified High Deductible Health Plans. 2018 Annual HSA Contribution Limits Single: $3,450 ($50 increase from 2017)…

Read More2017 Contribution Limit For Flexible Spending Accounts (FSA)

The IRS has announced that the maximum FSA contribution limit for 2017 will increase by $50 – from $2,550 to $2,600. This is the first increase to the limit in two years, and only the second increase since the limit was originally set at $2,500. The FSA limit increase is effective for FSA plan years…

Read MoreAffordable Care Act Penalty Updates

The annual baseline budget projections by the Congressional Budget Office and Joint Committee on Taxation (CBO), is projecting employer responsibility penalties to total $228 billion by the end of 2020. The individual mandate penalty will yield a projected $28 billion. The high-premium employer plan’s Cadillac Tax is expected to yield $18 billion. These penalty estimates…

Read MorePenalty Increases for Benefit-Related Violations

Recently, The Department of Labor published an interim final rule to adjust for inflation within the civil monetary penalties enforced by the Department of Labor. This Benefits Bulletin describes some of the adjustments made to the benefit-related civil monetary penalties enforced by the Employee Benefits Security Administration (EBSA) under the Employee Retirement Income Security Act…

Read More2017 Limits For High Deductible Health Plans (HDHP) And Health Savings Accounts (HSA)

The IRS released the 2017 Health Savings Account contribution limits, the minimum required HDHP deductibles, and the out-of-pocket maximums. Each year, the IRS reviews these figures based on a cost-of-living adjustment. The figures below pertain to HSA’s and HSA-qualified High Deductible Health Plans. 2017 Annual HSA Contribution Limits Single: $3,400 ($50 increase from 2016) Family:…

Read MoreCadillac Tax Delayed

On December 15, 2015, Congress approved a two-year delay of the Cadillac Tax. The “tax extender” package and provision was signed by the President, making it official. The Cadillac Tax effective date will move from 2018 to 2020. The delay was included in a year-end tax and spending package that also makes the Cadillac Tax…

Read MoreIRS Reporting Requirements – Final Forms and Instructions

On 9/17/2015, the IRS issued final forms and instructions for employer reporting relating to insured health plan coverage. The forms will be used to enforce Affordable Care Act employer penalties and individual mandate and tax credit eligibility rules with mandatory reporting starting in 2016 for the tax year 2015. Large employers with 50 or more…

Read MoreHSA Contribution Extended to Veterans

Effective 1/1/2016, the ability to make Health Savings Account (HSA) contributions will be extended to veterans, provided both of these criteria are met: Care is received through a Veteran’s Administration (VA) program Care is specifically for a service-connected disability If the VA hospital care or medical services are specifically affiliated to a service-connected disability, veterans are…

Read MoreSupreme Court Upholds ACA Federal Subsidies

Below is an article released today from Washington (Associated Press), detailing the Supreme Court’s ruling to uphold the Affordable Care Act’s federal subsidies. The ruling holds that the Affordable Care Act authorized federal tax credits for eligible Americans living not only in states with their own exchanges, but also in the 34 states with federal…

Read More2016 Limits For High Deductible Health Plans (HDHP) And Health Savings Accounts (HSA)

The IRS released the 2016 Health Savings Account contribution limits, the minimum required HDHP deductibles, and the out-of-pocket maximums. Each year, the IRS reviews these figures based on a cost-of-living adjustment. The figures below pertain to HSA’s and HSA-qualified High Deductible Health Plans. 2016 Annual HSA Contribution Limits Single: $3,350 (unchanged from 2015) Family: $6,750…

Read MoreEmployer Reporting – Final Forms Available

The IRS has issued final forms and instructions for employer reporting and notices relating to insured health plan coverage. The final versions are largely unchanged from the prior draft versions. The forms will be used to enforce Affordable Care Act employer penalties and individual mandate and tax credit eligibility rules with mandatory reporting starting in…

Read More